SME & Startup, please be reminded that failure to submit Tax Form E will cost you a tax penalty with minimum RM200 to maximum RM20,000 or imprisonment or both.

In this sharing, we will provide you the following information:

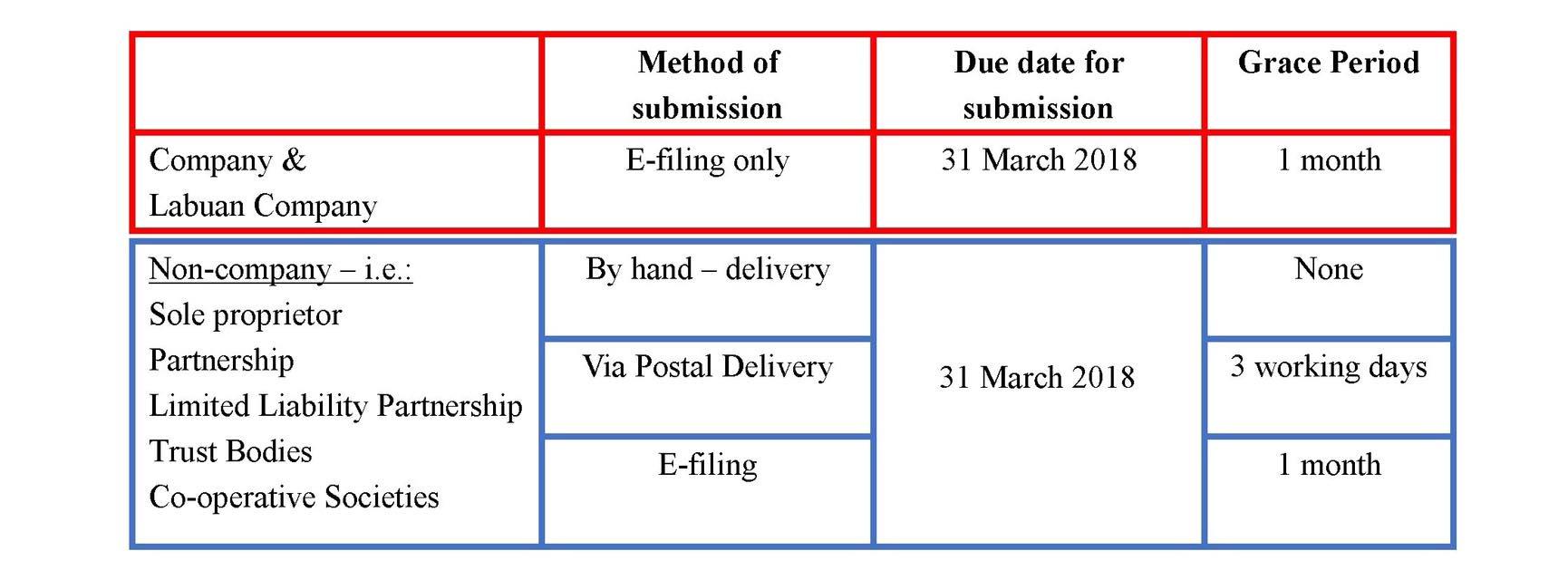

1) The due date to submit tax form E.

2) How to submit tax form E.

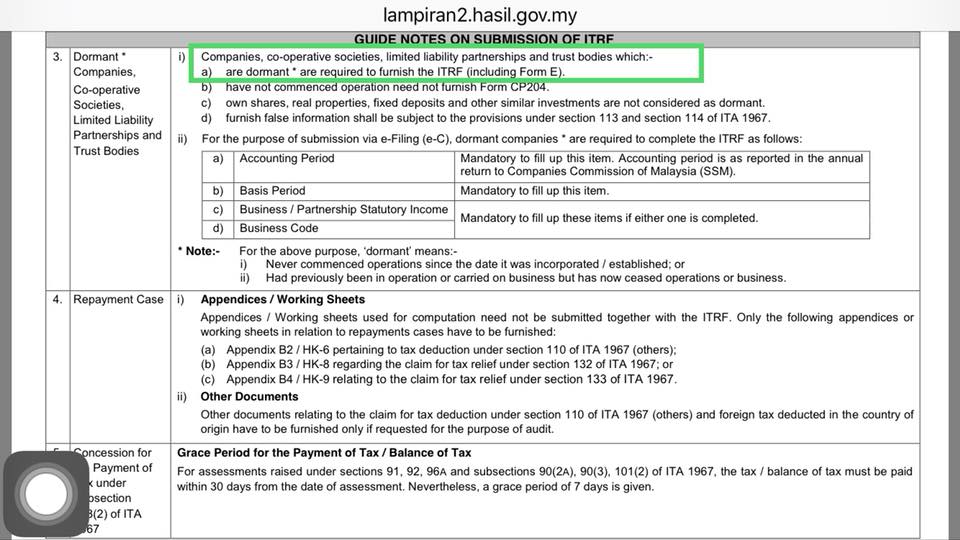

3) Can your company be exempted to submit tax form E?

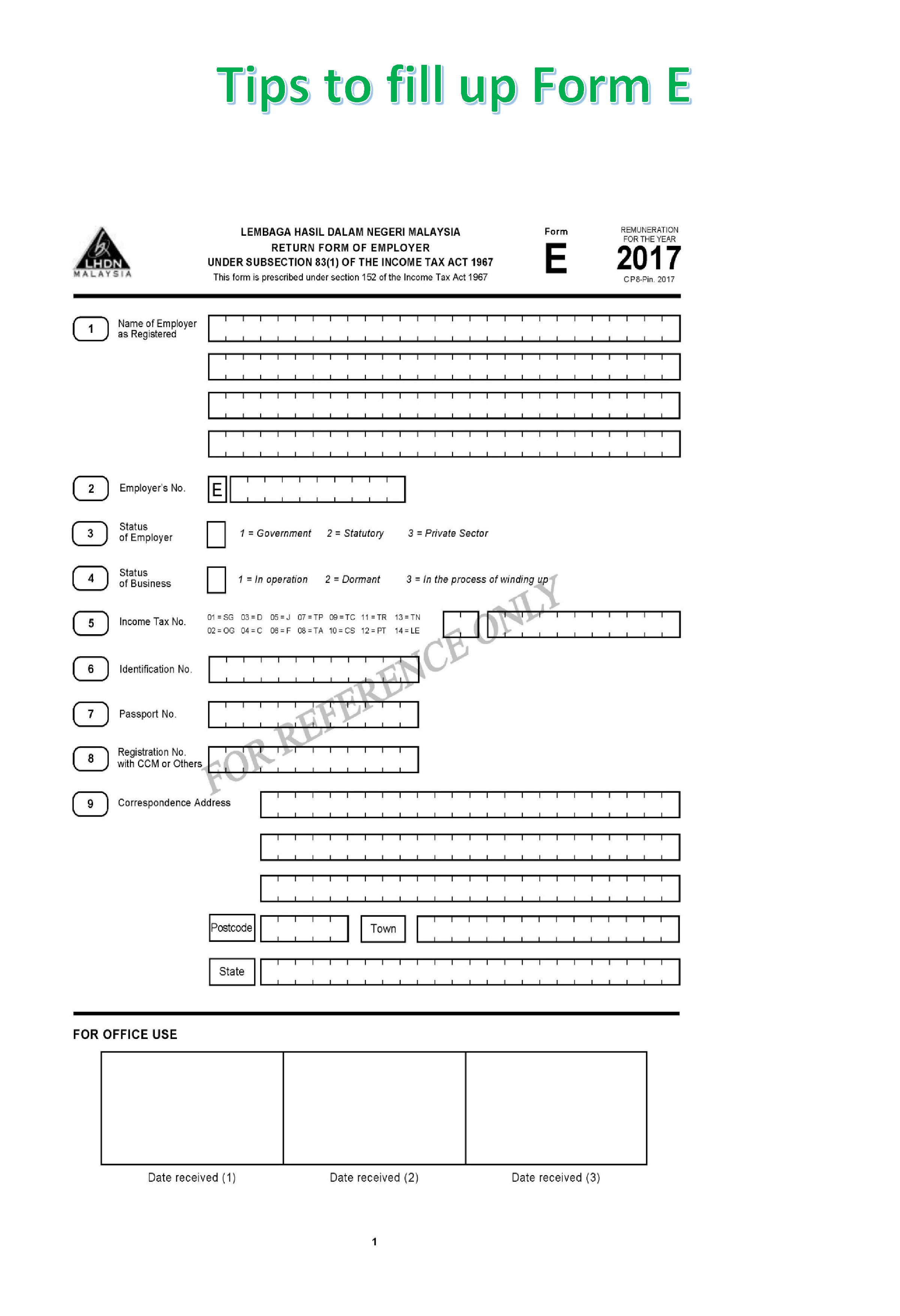

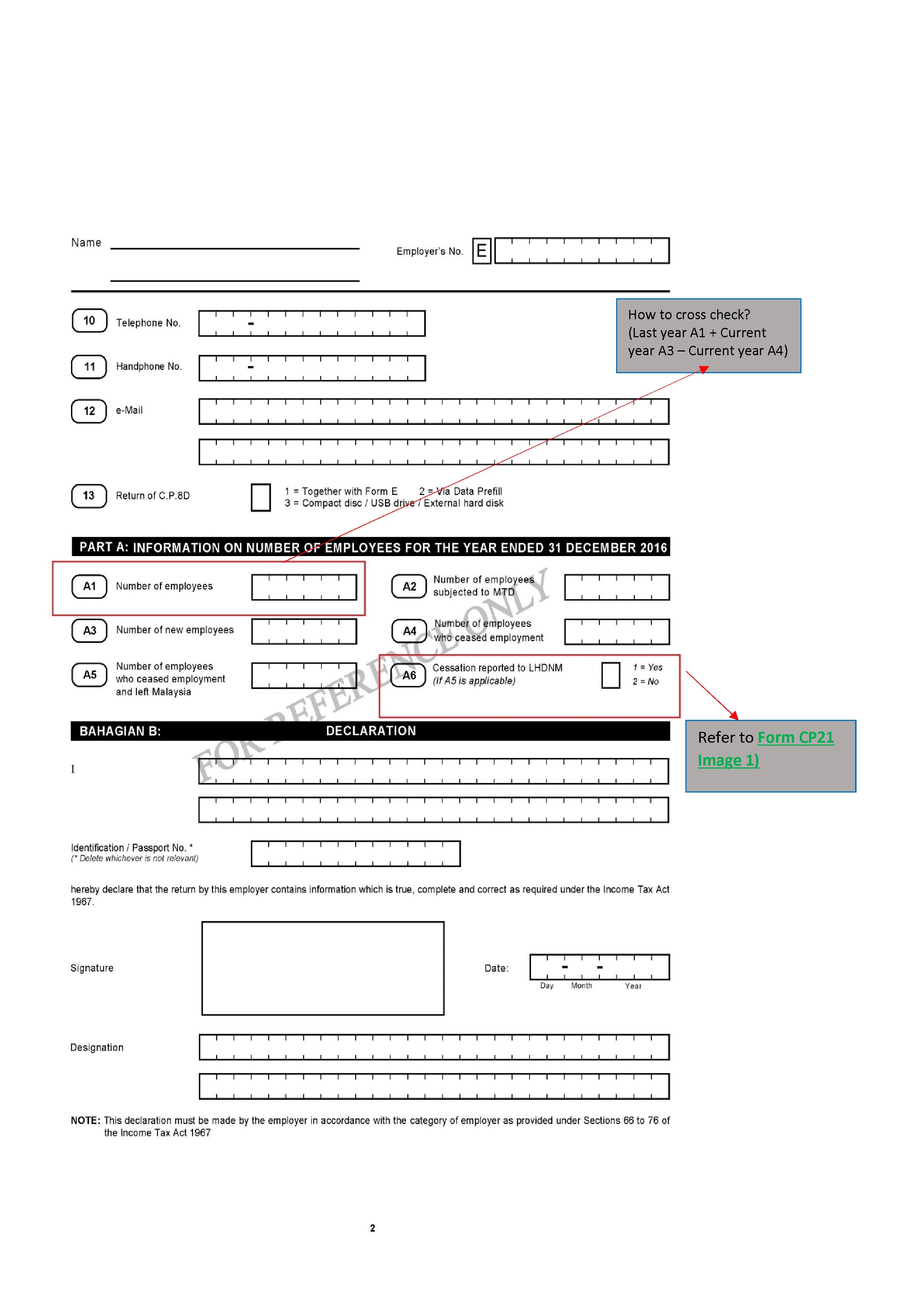

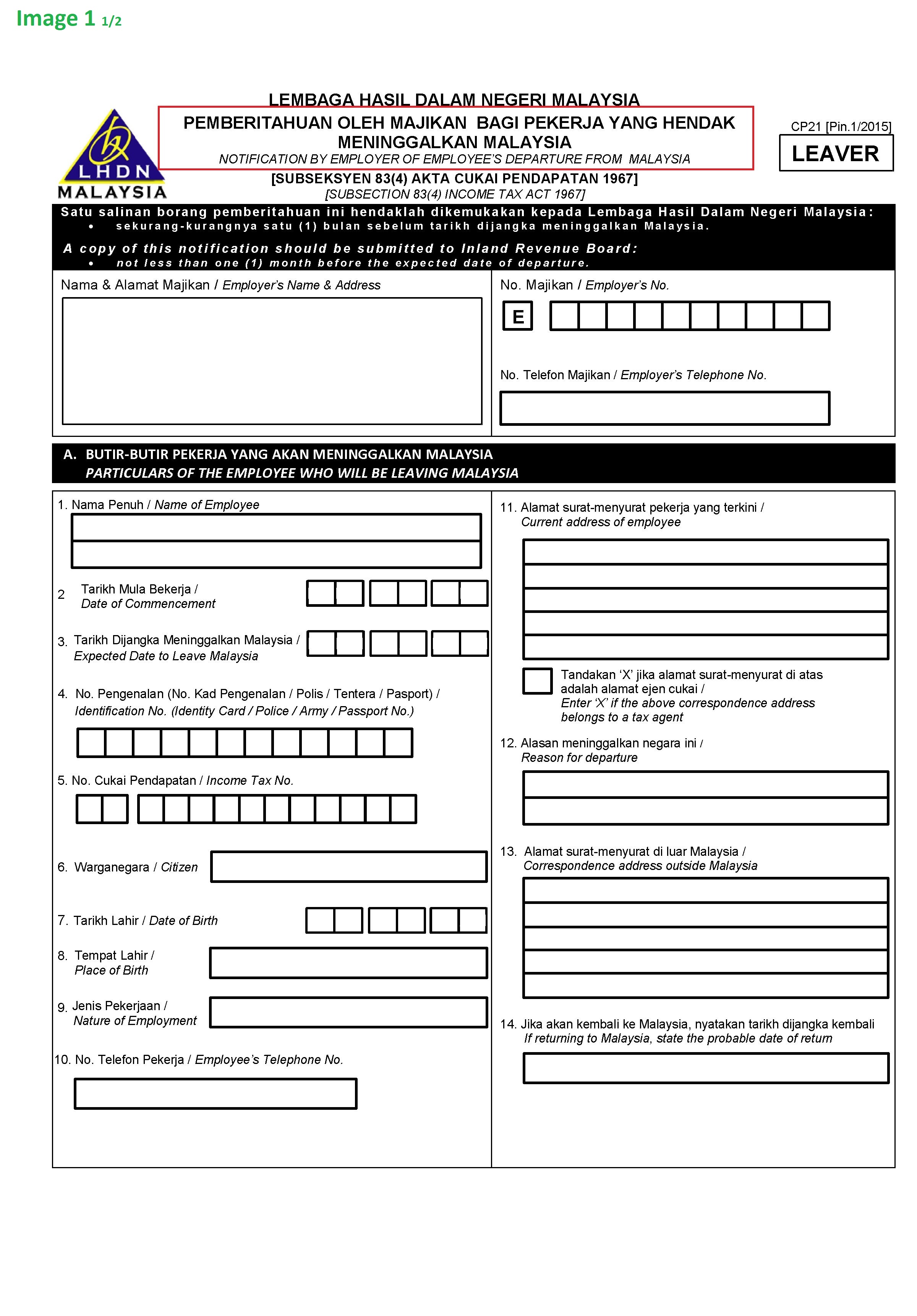

4) Tips for common questions when you fill up tax form E.

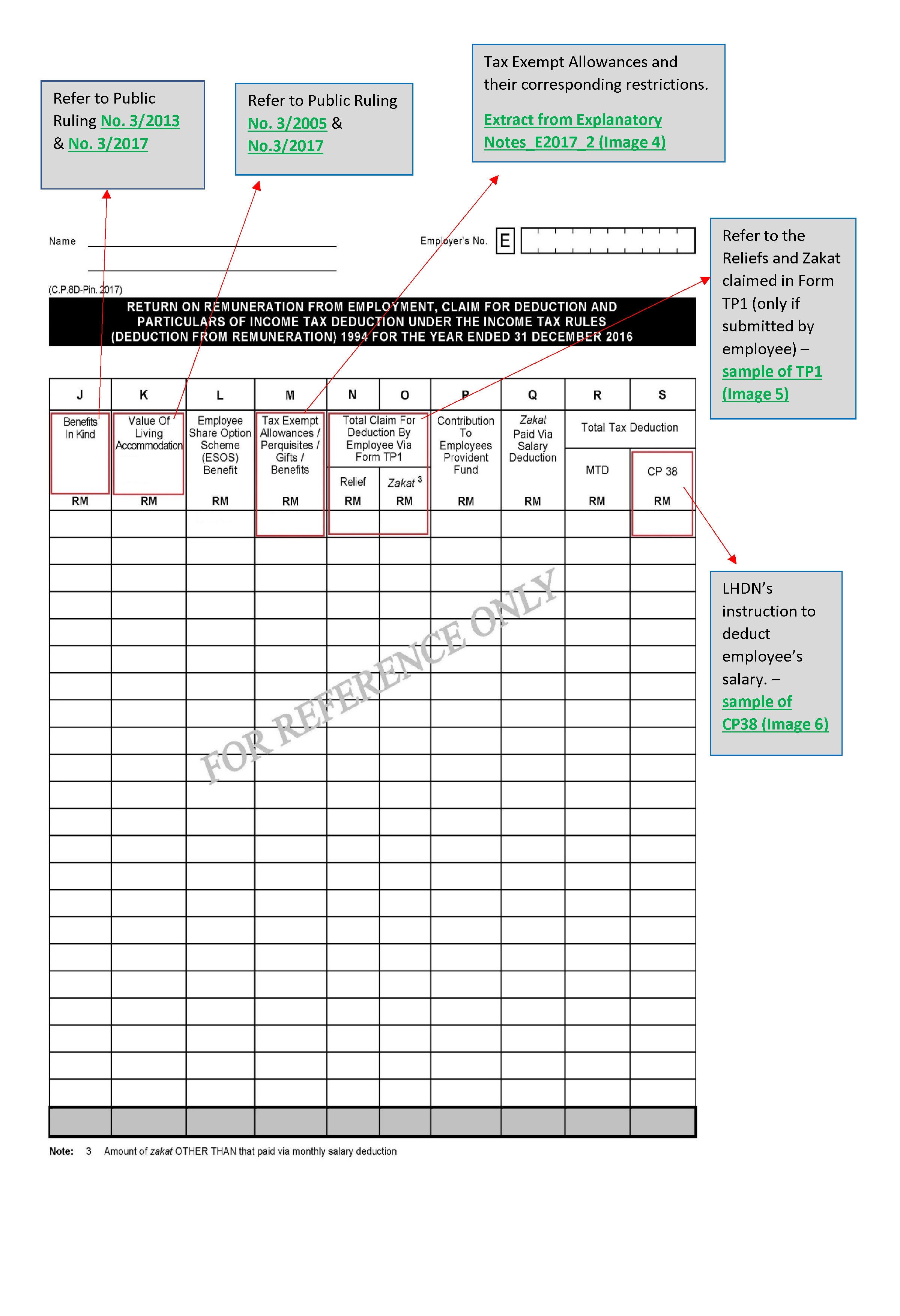

Public Ruling No. 3/2005 : http://lampiran2.hasil.gov.my/pdf/pdfam/PR3_2005.pdf?CSRF_TOKEN=816dc0fe3971e6ed1e98bf12dba83d72cabc686d

Public Ruling No. 3/2013 : http://lampiran1.hasil.gov.my/pdf/pdfam/PR3_2013.pdf?CSRF_TOKEN=816dc0fe3971e6ed1e98bf12dba83d72cabc686d

Public Ruling No. 3/2017 : http://lampiran1.hasil.gov.my/pdf/pdfam/PR_3_2017.pdf?CSRF_TOKEN=816dc0fe3971e6ed1e98bf12dba83d72cabc686d