GST is implemented in Malaysia since 1st April 2015. There are Hidden Champions which do not require to be registered for GST because their “Taxable Turnover” (for definition: please refer to page 6 in this PDF) are lower than the “prescribed threshold of RM500,000.00” for a period of 12 months.

For businesses which do not register for GST, please be reminded that the “prescribed threshold of RM500,000.00” is a constant check point for you to monitor. This is because:

- Failure for GST registration will be subjected to fine not exceeding RM30,000 or imprisonment not exceeding 2 years or to both.

- Penalty for late registration is RM1,500 within period of 30 days and not exceeding RM20,000 for period more than 360 days.

- All value of supplies make on or after “Effective Date” will be deemed GST inclusive.

According to Custom Malaysia’s ruling, we can examine “prescribed threshold of RM500,000.00” either using “Historical Method” or “Future Method” (for definition: please refer to page 7 & 8 in this PDF). You may refer to below for details:

Historical method

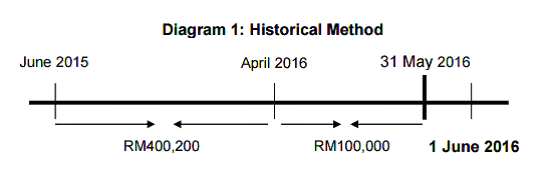

Historical method is based on the value of the taxable supplies in any month plus the value of the taxable supplies for the eleven (11) months immediately before that month. The determination is explained as in Diagram 1.

- Taxable supply for the month of May 2016: RM100,000

- Taxable supply from June 2015 to April 2016 (11 months preceding): RM400,200

- Total taxable supply from June 2015 to May 2016: RM500,200

So, liable to be registered and to notify within 28 days from the end of May 2016.

Effective Date of registration: 1 July 2016

Future method

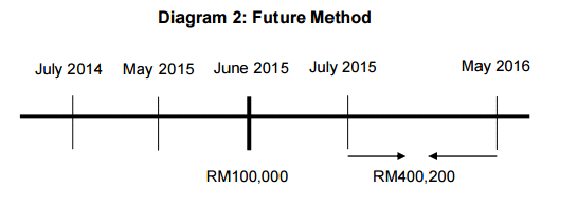

For Future method, the taxable turnover is based on the value of taxable supplies in any month plus the expected value of taxable supplies for the eleven (11) months immediately after that month. The determination is explained as in Diagram 2.

- Taxable supply for the month of June 2015: RM100,000

- Expected taxable supply from July 2015 to May 2016 (future 11 months): RM400,200

- Total taxable supply from June 2015 to May 2016: RM500,200

So, liable to be registered within 28 days from the end of June 2015.

Effective Date of registration: 1 August 2015

Businesses making taxable turnover LESS than RM500,000 may voluntary register (for details: please refer to page 8 & 9 in this link 3) for GST. However “Voluntary Registration” shall remain registered for 2 years.

For further clarification, you may seek advices from Customs Malaysia or GST registered Tax Agents.

For more general information about GST, please refer here.

To register GST online, please refer here.

自从消费税在01/04/2015正式实施,仍有许多商家还未注册消费税,因为他们连续12个月的纳税营业额 (Taxable Turnover) (纳税营业额的定义请参考此链接的第六页)还未超过关税局所规定的注册门槛(RM500,000.00)。

如贵公司仍未注册消费税,我们想借此机会提醒您必须定期检查您的纳税营业额 (Taxable Turnover)以避免以下的窘境:

- 符合资格但未注册消费税的商家可被罚款不超过RM30,000、坐牢不超过2年或两者兼施。

- 逾期注册消费税的商家可被罚款至少RM1,500(逾期30天内)或高达RM20,000(逾期超过360天)。

- 在消费税的“生效日期”当日或以后,所有纳税供应将被视为包含消费税。

根据消费税法令,商家可以通过“ 过往方式”(Historical Method)或“未来方式” (Future Method)(定义请参考此链接的第七和第八页)来检查消费税注册门槛(RM500,000.00)。您可参考以下例子:

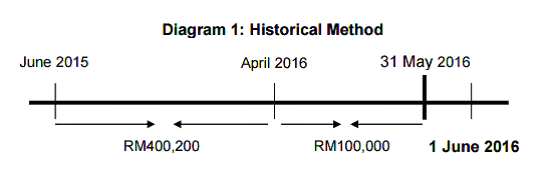

消费税 – 过往方式(Historical Method)

- 在5月2016年的纳税营业额: RM100,000

- 6月2015年至4月2016年的纳税营业额(之前11个月): RM400,200

- 6月2015年至5月2016年的总纳税营业额: RM500,200

所以,从31/05/2016,商家必须在28天内注册消费税。

消费税生效日期:01/07/2016

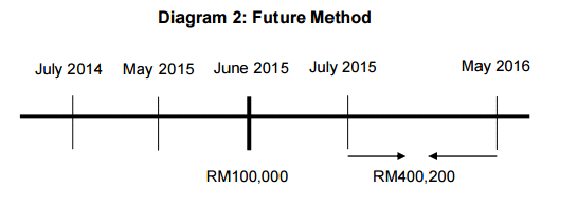

消费税 – 未来方式 (Future Method)

- 在6月2015年的纳税营业额: RM100,000

- 7月2015年至5月2016年的纳税营业额(之后11个月): RM400,200

- 6月2015年至5月2016年的总纳税营业额: RM500,200

所以,从30/06/2015,商家必须在28天内注册消费税。

消费税生效日期:01/08/2015

如贵公司的纳税营业额 (Taxable Turnover)仍未超过注册门槛(RM500,000.00)您仍可选择自愿注册消费税(自愿注册消费税的详情请参考此链接的第八和第九页),但是自愿注册消费税的商家们必须保留注册为期两年。

欲知更多详情,请咨询关税局或消费税注册代理。

**以上一切以英文为准。

欲知更多关于消费税的资讯,请浏览这里。

欲注册成为消费税商家,请浏览这里。